The approval of Amarin’s Vascepa Iscosapentyl Ethyl (97% EPA EE) in the United States launched a new, effective treatment for cardiovascular diseases (CVD). According to a report by Jefferies India, Amarin sold over 500 million Vascepa capsules in the United States in 2020, using approximately 500 tons of 97% EPA EE. Amarin’s expected expansion into the EU and China in 2021 will significantly increase its total demand for 97% EPA EE. In fact, at the beginning of 2021, the first prescription for Vascepa was officially filled in the Hainan Boao City International Medical Tourism Area in China.

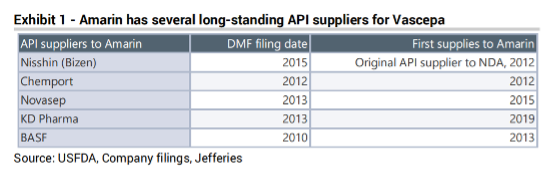

Amarin seems to have secured its supply of the active pharmaceutical ingredient (API) for 97% EPA EE. Through its well-developed supply chain partners, Amarin should be able to double its supply of 97% EPA EE. However, Vascepa’s expanded sales will severely constrain the overall supply of this API, making it difficult for other companies to launch generic versions of Vascepa.

Generic drugs are medicines that are the same in dosage, safety, and efficacy for the same indications as the approved therapeutic. After the expiration of the patents protecting an approved medicine, other pharmaceutical companies can petition to have their generic drugs approved for use. One of the most critical elements of regulations governing the approval of generic drugs is that generic medicines must contain the same active molecules as the original drugs. Generic medicines not only increase the supply of medicines, they also offer consumers a significant saving, reducing overall healthcare cost and expanding patient access to life-saving medicine. New sources of supply of 97% EPA EE will be needed to support the development of generics in the European Union and the Chinese markets.

Two leading generic EPA companies, Hikma and Dr. Reddy, have primarily sourced their EPA API from CCSB of Taiwan. Limited options exist for other companies to launch generic versions of Vascepa. Two critical issues affecting the development of generic EPA drugs are:

- Limited number of qualified EPA API producers

Current EPA API are all based on fish oil. However, since fish oil also contains DHA, a fatty acid that must be removed to produce the EPA API, a producer has to have significant technical expertise and specialized equipment to produce the EPA API. Only a few companies in the world have the capabilities to produce EPA API and most of them are bound by exclusive supply agreements with Amarin. A novel EPA source that can simplify the production of EPA API can broaden the supply of EPA API, enabling the development of generic Vascepa. Microalgal EPA, which does not contain DHA, has the potential to enable a novel process to reduce the complexity of EPA API production.

- High EPA API cost

A generic medicine is usually less expensive than the patented medicine. However, because of the technical challenges in the production of EPA API and the limited number of suppliers, the current cost of available EPA API is high, making it difficult for a potential generic pharmaceutical company to offer a product that is cheaper than Vascepa. In the Jefferies report, Hikma was reported to earn a gross margin that was significantly lower than the 79% reported for Vascepa. Without a meaningful saving, generic Vascepa would not be able to compete with Vascepa. Microalgal EPA production is scalable and sustainable, presenting a potential option to address the tightening supply of EPA raw material.

According to the 2019 China Cardiovascular Health and Disease Report, 330 million Chinese suffer from CVD and annual CVD mortality is over 4 million. From 2012 to 2016, the annual cost of cardiovascular and cerebrovascular treatments in China increased from CNY310 billion to CNY495 billion. With an increasing CVD patient population, demand for effective CVD treatments will continue to increase in China. Vascepa is the only prescription drug that has been proven to reduce the risk of cardiovascular disease by 25%. It is expected that demand for EPA EE based therapeutics and statins in China will expand significantly.

Xiaozao Technology is a leading large-scale producer of microalgal EPA. After 10 years of research and development, Xiaozao Technology is poised to launch its exciting line of microalgal EPA and microalgal biomass products for human and animal nutrition. Xiaozao Technology’s unique, scalable production platform will position it well to play a meaningful role in meeting the expanding global demand for EPA API.